· Over one in five (22%) retail businesses in the UK aren’t confident of trading through to the end of 2023.

· Three in five (60%) retailers citing increased energy costs as the biggest pressure on their profit margins.

· Two-thirds (66%) of retailers having seen an increase in operating costs in 2022 – by 21% on average – the industry faces a number of market headwinds, including increased wholesale, labour, logistics and warehousing costs.

· Just over a fifth (21%) took on new debt in 2022, with a significant majority (68%) of all respondents expecting to seek an increase in debt facilities from lenders this year.

When it comes to smaller businesses, they often operate in highly competitive markets where the ability to quickly respond to changes can give them a competitive advantage. Being agile can help small businesses to stay nimble and innovative; important for staying ahead of the curve and maintaining growth.

Those with agility are able to respond quickly and flexibly to new opportunities, emerging threats, and changing customer trends.

However, smaller businesses can also be more vulnerable to disruptions due to more limited resources and ability to withstand financial shocks.

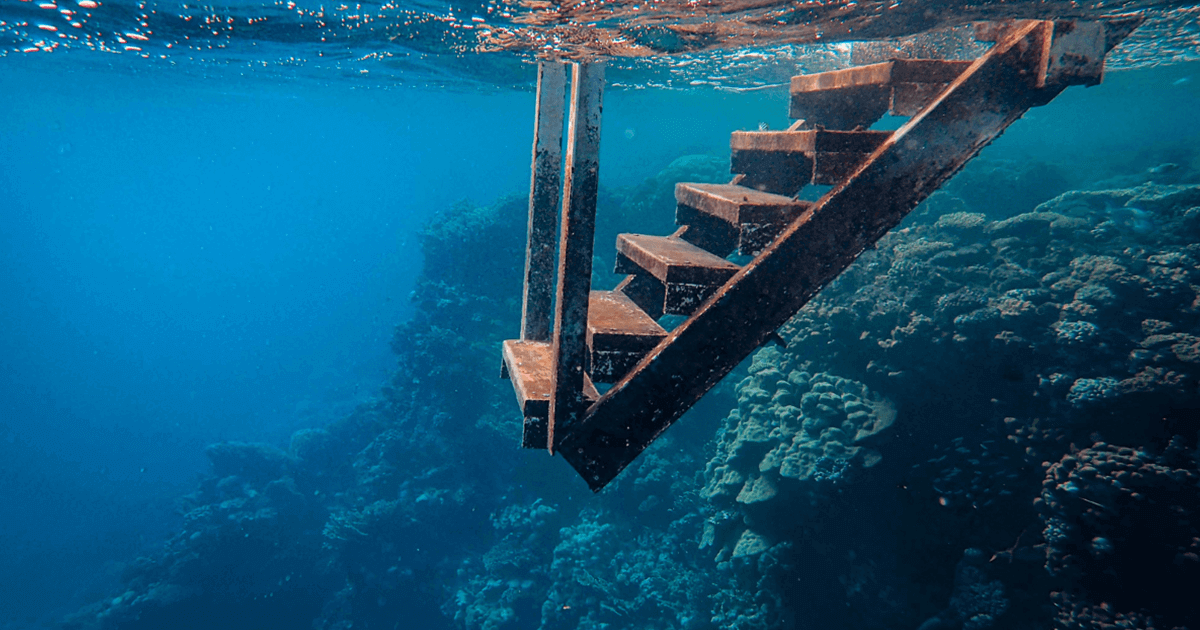

Even Keel Solutions has seen an increase in insolvency cases from the retail and hospitality sector of late. Already reeling after the pandemic, those that made it through to a period of brief recovery, are now receiving a double whammy of disaster with the energy crisis affecting many of their customers and clients. Footfall is reduced and costs have increased.

It's important for small and larger businesses to have a financial contingency plan in place to ensure business continuity. A plan that documents the worst-case ‘what if’ business scenarios. What the impact would be and what you would do about it. The plan should focus on finances and resources.

Even if it's impossible to anticipate every potential risk, having a Plan B can help businesses quickly adapt to unexpected changes and keep operations running smoothly.

Your Plan B should of course be tailored to your own specific needs and goals, but it should broadly include aspects of business funding and cost cutting, both in the short and long term:

1. Funding. Ideally a business should have 3-6 months of protected operational cashflow at its disposal. When accompanied by a cash flow analysis, a business owner can clearly predict what will happen in the business financially speaking and when.

2. Cost analysis. The cash flow analysis will help with this too as will a grip on your monthly finances by way of your P&L. Make a plan that addresses a short- and a long-term cost cutting exercise.

3. Diversify income streams. Multiple sources of income makes it easier when one source is impacted. The other sources of income can cover expenses. Determine your ‘what if’ scenarios here and plan your course of action.

4. Reduce debt. Pay off or re-negotiate terms of your credit cards, debts and loans thereby freeing up cashflow to be used on operational expenses or investing in further opportunities and income streams.

5. Insurance. This can include health insurance, life insurance, and business interruption insurance. Insurance can help mitigate financial risks by providing a safety net in case of unexpected events.

· Having a contingency plan in place puts a small business owner at a competitive advantage to those that don’t.

· Averts panic within your team and panic within your stakeholders. A clear and actionable plan can allay fears and provide structure in an otherwise turbulent time.

· Minimises losses. Your Plan B will tell you when the time is right to bow out, cut your losses and talk to your accountant or an insolvency practitioner.

· Reduces the risk of uncertainty. By being prepared you won’t be caught off guard.

Most financial plans focus on profit not on a Plan B, but in these volatile times it is pertinent to do both.

If you’re experiencing financial distress in your business and need some help, please do get in contact with us for a no-cost initial and confidential conversation. Call us on 01202 237337.

We’re an experienced team with strong values. We like to understand your needs and ensure you have the best advice possible. We’re experts in all areas of insolvency; you can read more about us on our website here.

Our download guide is ideal for both accountants and business owners. You’ll get the benefits of our 30+ years experience in one easy to read guide.

Afterwards, you’ll not only gain a better understanding of the processes, but you’ll also discover how we’ve helped hundreds of companies and provided peace of mind to countless business owners.